A better tool for DeFi

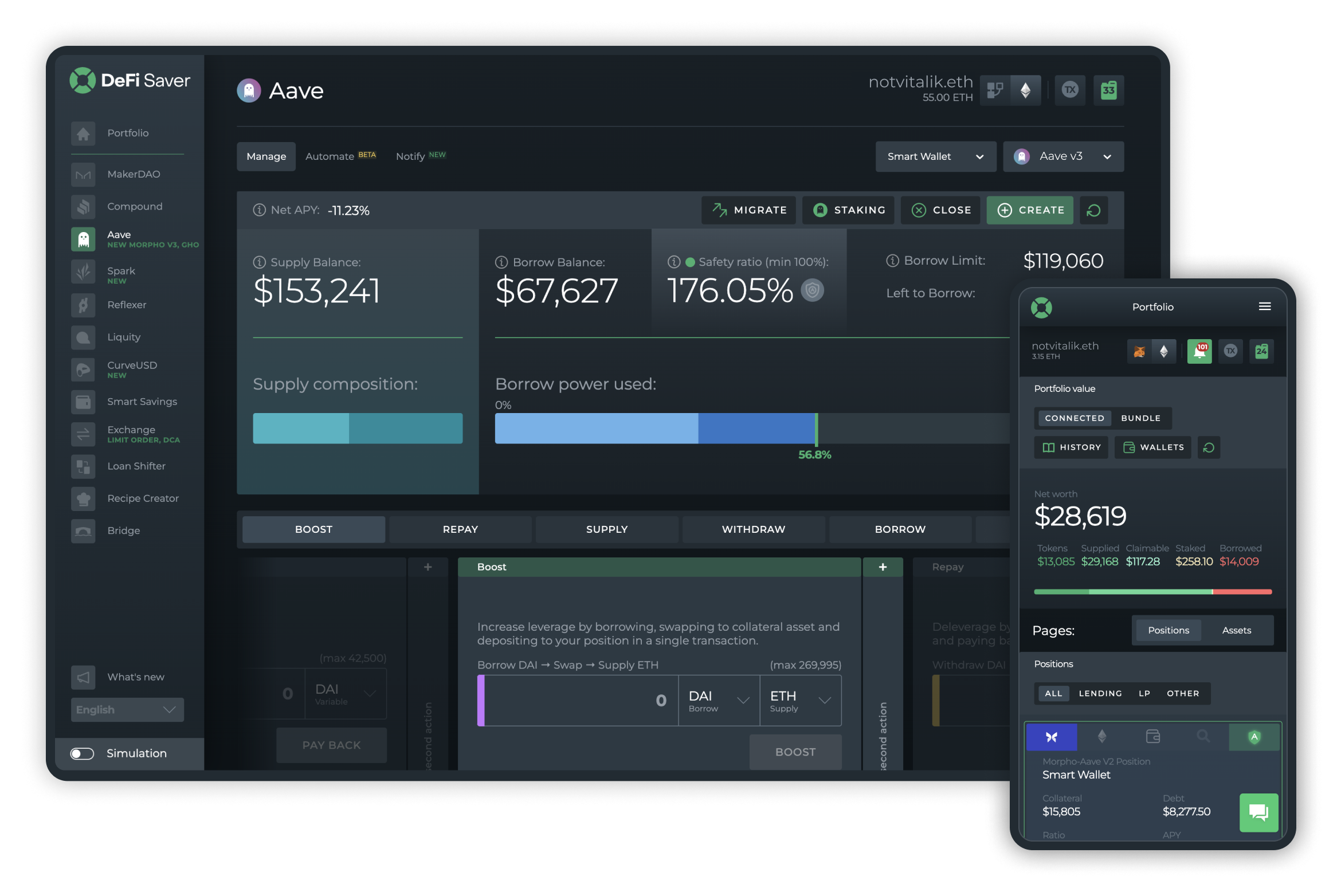

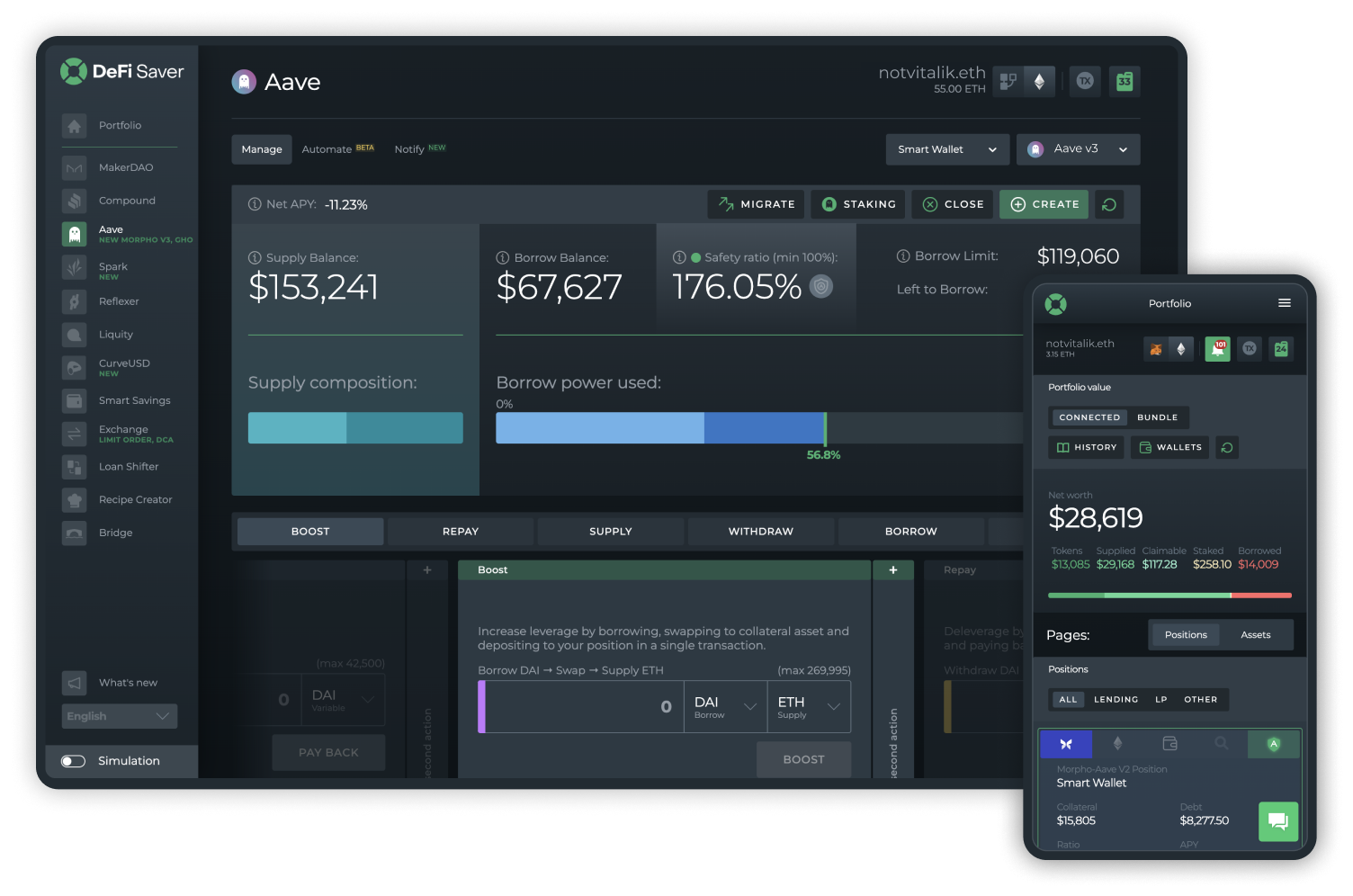

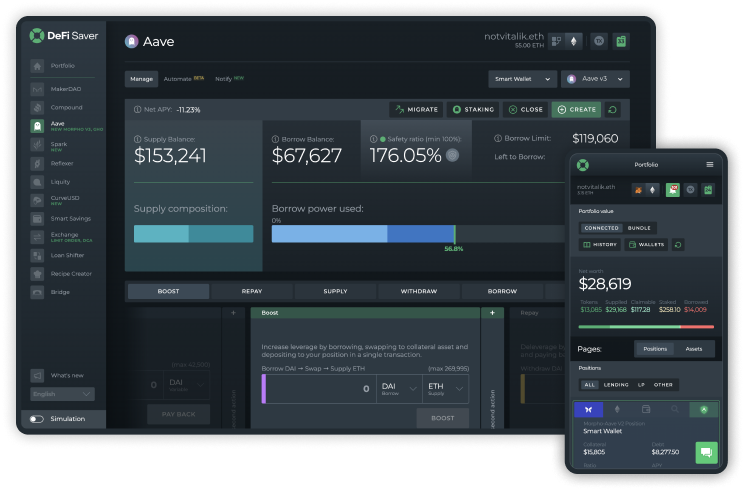

DeFi Saver is a non-custodial DeFi management tool offering advanced features and functionalities for managing your positions and crypto assets in various DeFi protocols

686K+

User transactions

$10.5B+

Trade volume

$345M+

Total automated

1K+

Positions automated

Featured16

Networks4

Protocols16

DEXes & Aggregators7

Wallets10

Infrastructure3

Everything you need in one app and more

All the essential tools for tracking and managing your DeFi portfolio with a layer of advanced features on top.

Lending & borrowing

Utilize integrated lending protocols to either earn an interest on your deposits or collateralise your assets to borrow other tokens against them, with different assets and rates available in different protocols.

Learn moreAdvanced decentralized exchange

Make instant token swaps or set up limit orders and DCA strategies, all in a non-custodial and trustless manner, with liquidity sourced through meta-aggregation to find the best rates for you.

Learn moreLeverage management

Create or close leveraged positions in one transaction and manage leverage easily with our signature Boost and Repay leverage adjustment options.

Learn moreLoan shifter

Move your position between different protocols and make collateral or debt swaps in active positions, all in a few clicks and just one transaction.

Learn moreDFS Automation

Protect your position from liquidation, minimize losses and maximize profits with automated options such as stop loss, take profit, trailing stop and automated leverage management.

Learn moreCustom transaction builder

Create your own unique, complex transactions combining a number of interactions with different protocols, as well as flash loans and token swaps, to complete the exact thing you need.

Learn moreDiscover the best options to- Long Bitcoin

- Borrow

- Leverage

- Earn Yield

- Long Ether

- Leverage Stake

- Long Bitcoin

- Borrow

- Leverage

- Long Bitcoin

- Borrow

- Leverage

- Earn Yield

- Long Ether

- Leverage Stake

- Long Bitcoin

- Borrow

- Leverage

Discover the best options to

Filter and sort markets by assets, APYs, and LTVs. Browse preset strategies for yield farming and margin trading. Explore opportunities of top tier DeFi protocols without connecting your wallet. Find your place in DeFi in one view with DeFi Saver Discover.

ETH

USDC

Long Ether

Aave v3 Prime

WBTC

ETH

Borrow

Aave v3 Core

wstETH

USDS

Long Ether

Spark

wstETH

USDC

Long Ether

Morpho Market rate

USDC

GHO

Yield Farm Stables

Aave v3

WBTC

wstETH

Borrow

Aave v3

ETH

crvUSD

Long Ether

crvUSD

ETH

USDC

Long Ether

Fluid

ETH

USDCe

Long Ether

Compound v3

WBTC

USDT

Long Bitcoin

Compound v3

USDC

ETH

Short Ether

Aave v3

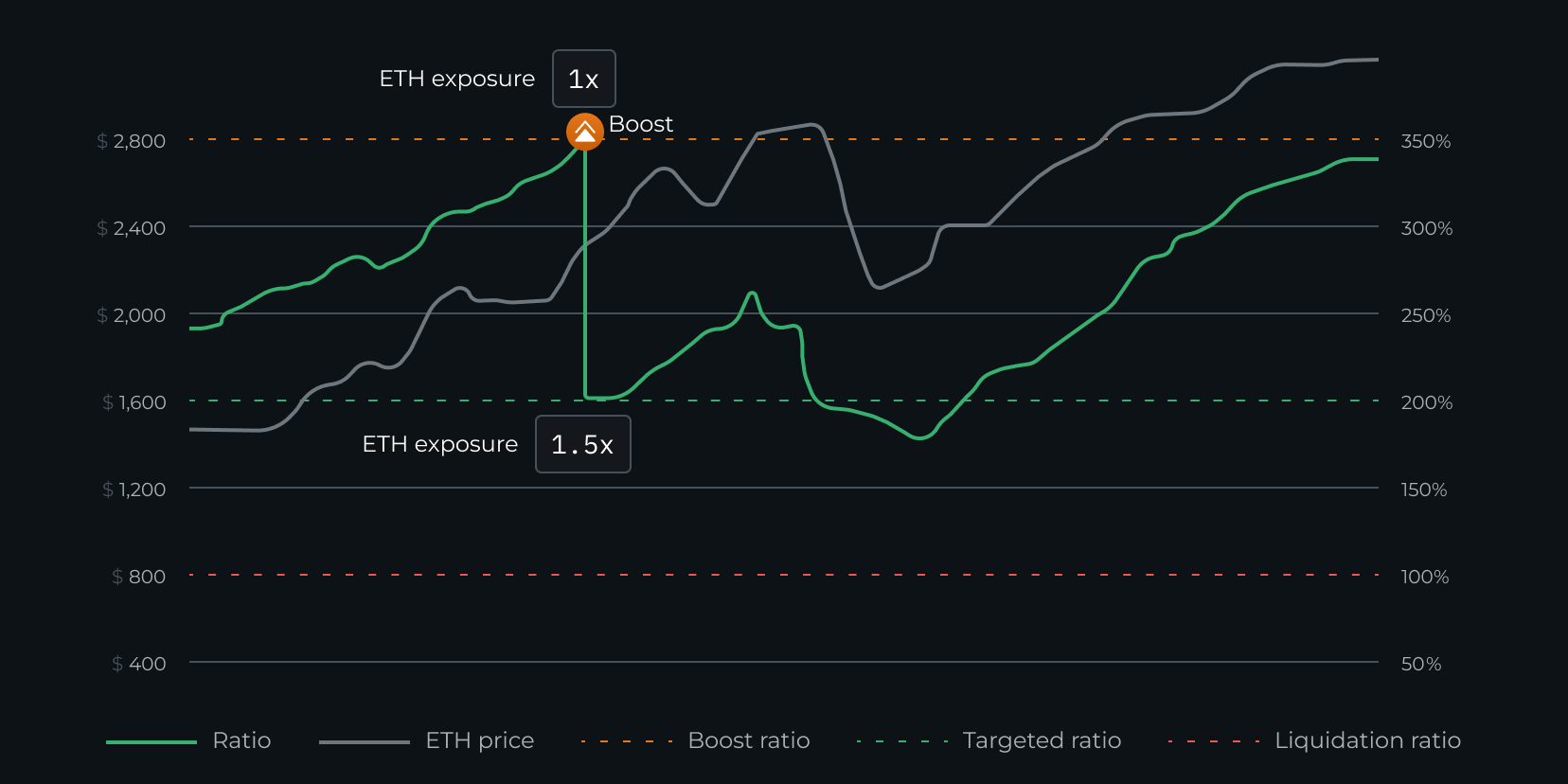

Automate your position for the best results

Automation can manage your leverage and protect your position from liquidation based on your input, non-custodially and trustlessly.

Automatically increase leverage of your position once your collateralisation ratio grows above your configured threshold.

Safety first DeFi

Each design decision at DeFi Saver is made with a security-first approach

Audited smart contracts

DeFi Saver smart contracts have been audited by ConsenSys Audits and Dedaub with audit reports available here.

Battle-tested protocols

Our goal is to provide a curated DeFi experience with access to top-tier protocols that have been extensively audited and thoroughly battle-tested over significant periods of time.

Bug Bounty

To ensure a continuously safe environment for our users, we have constantly open bug bounties on Immunefi that you can check out here.

Non-custodial and trustless

All positions at DeFi Saver are fully non-custodial with you always in control, and all protocol interactions are performed in a trustless manner through the use of our smart contracts.

TxSaver - Smoother and safer flow for your transactions

Simply sign your wanted transaction and let TxSaver handle the rest. All transactions are protected from MEV, no ETH is needed for gas fees, and there are no additional service fees.

Create your own DeFi recipes

Combine various DeFi actions, create unique protocol interactions and execute them in a single transaction.

What our users are saying

More from the ecosystem

ETH Saver

Boost yield on your staked ETH through the use of different DeFi lending protocols with a fully non-custodial application for leveraged staking.

Maker Explore

Find current and historical information on collateralized debt positions in the MakerDAO protocol.

Liquity Explore

Easily check different Liquity troves, system stats, and historical data within Liquity protocol.

Liquity V2 Explore

Easily check different Liquity V2 troves, system stats, and historical data within Liquity V2 protocol.

Chicken Bonds Explore

Enter bond ID, user address, or transaction hash to explore current and historical events, within Liquity Chicken Bonds.

DFS Stats

Track DeFi Saver stats and platform activity, automation stats, and smart contract updates across all supported networks and protocols.

Gas Extension

Ethereum gas prices extension with current gas details and historical charts. Available for Firefox and all Chromium-based browsers.

Blog

Jun 25.

Halving the number of failed txs: Swap improvements at DFS

We have introduced a new and improved swap route optimisation with automated fallbacks, which not only optimises finding the best possible swap rates for our users, but it has also halved the chances of your swap transaction failing.

ReadJun 6.

DeFi Saver Newsletter: May 2025

Welcome to our latest newsletter, covering recent DeFi Saver updates, latest stats, and ecosystem happenings amid Q2!

ReadMay 30.

Powertools for Pendle users on Aave: Rollover & Unwind

DeFi Saver just got a fresh new feature that caters to Aave and Pendle enthusiasts. Users can now easily prolong their yield-earning endeavors and swap expired pTokens for those with a later maturity rate, as well as close or repay their positions in a matter of a few clicks.

ReadMay 16.

DFS Discover now includes NET APY estimates

DeFi Saver's Discover page just got a new update. Users can now customize their loan searches with our new NET APY estimate option and find optimal conditions for their investment strategies.

ReadMay 14.

DeFi Saver Newsletter: April 2025

Latest DeFi Saver news, releases, as well as some ecosystem highlights from Q1 2025.

Read